9 July 2020

Dear Tenant,

NSW Response to COVID-19 Rental Relief

Rent Relief Principles for Maritime Commercial Marinas

We refer to the letter dated 24 April 2020 outlining the NSW Governments response to COVID-19 and the rent relief principles available.

Discussions with the boating industry and commercial vessel industry representatives identified that the methodology adopted in the letter dated 24 April 2020 did not provide adequate support for the unique business model that Commercial Marinas operate under.

Transport for NSW has therefore concluded a more measured approach for commercial marina operators in relation to rent relief as outlined below:

Rent Relief Principles:

Rent Deferral

Commercial Marinas can apply for rent deferral for six months on request, where deferred rent is repaid in full over the period which is the lesser of; the remaining lease term or 24 months.

Rent Abatement for commercial marinas without commercial sub-tenants

Marinas which operate without commercial sub-tenants may apply for rent abatement in accordance with the rent abatement principles communicated in our letter dated 24 April 2020. Where their turnover has reduced by less than 30% the amount to be repaid in the future will be adjusted by the reduction in calculated supplementary rent (Turnover rent) applicable.

As an example, a marina that experiences a 15% reduction in turnover for the period April to September 2020 can request deferral of rent and will ultimately get a reduction in rent of the actual verified 15% for the period affected as the supplementary rent will be reduced by the turnover calculation reducing the amount of deferred rent to be repaid.

For marinas that don’t have a turnover rent mechanism, the same principle will be applied based on the provision of turnover reduction evidence (for example BAS statements for 2019 and 2020).

This will see marinas that have experienced a minimum of a 30% decrease or more in revenue between April and September 2020 being entitled to initial rent abatement and marinas with less having the amount of deferred rent to be repaid commensurately reduced.

Rent Abatement for commercial marinas with commercial sub-tenants

Marinas which operate with commercial sub-tenants will be able to request rent abatement based on the actual dollar abatement/deferral provided to sub-lessees up to the amount of the total rent payable under the head lease. This requires the marina to provide monthly account information highlighting the level of abatement offered to sub-tenants from 1 April 2020 to 30 September 2020.

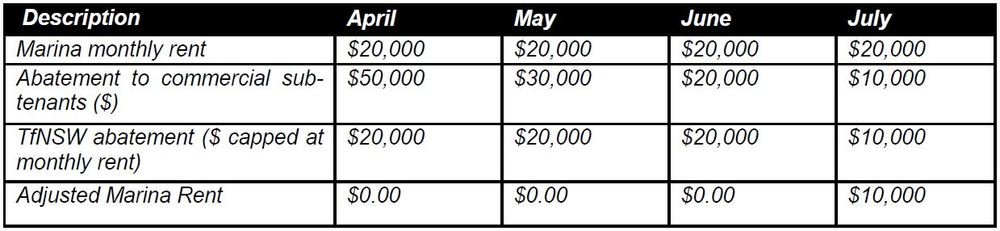

Example: dollar for dollar rent abatement to commercial marina with commercial sub-tenants

Notes:

1. This concept would apply for the period 1 April 2020 – 30 September 2020.

2. Commercial Vessels with berthing licenses will be treated as a commercial sub-tenant. (Evidence of vessel DCV registration required).

3. Rent abatement will be calculated monthly.

The above principles will be applied to the income generating activities within the leased area only.

Should you have any further questions, please do not hesitate to contact our office to discuss this in further detail.

Yours sincerely,

CI AUSTRALIA PTY LIMITED

Aaron Gaida

Portfolio Contract Manager

M: +61 405 172 300

E: agaida@ciaustralia.com.au